SILVER VAULT

"Low risk & volatility"For investors who desire to learn to invest in well-diversified ETFs that track low risk indexes while looking to achieve sound returns.

Annual Yield:

9.6%*Please refer to our general disclaimer for more details.

Who is it designed for?

We understand that not everyone is comfortable with investing in stocks and that’s perfectly normal. Our Silver Vault package is specially designed with conservative risk investors in mind.

Diversify your risk

Affordable & flexible

Highly reliable charting patterns

DIVERSIFY YOUR RISKS

Exchange-traded funds (ETFs) are traded securities that track a basket of stocks on a stock exchange.Imagine being able to mitigate risks & gain exposure to virtually any market in the world or industry sector through just one single share.

AFFORDABLE & FLEXIBLE

ETFs can be traded at any time when the market is open. Unlike mutual funds, ETF's management fees are much lower.Save on the fees and reinvest for greater growth.

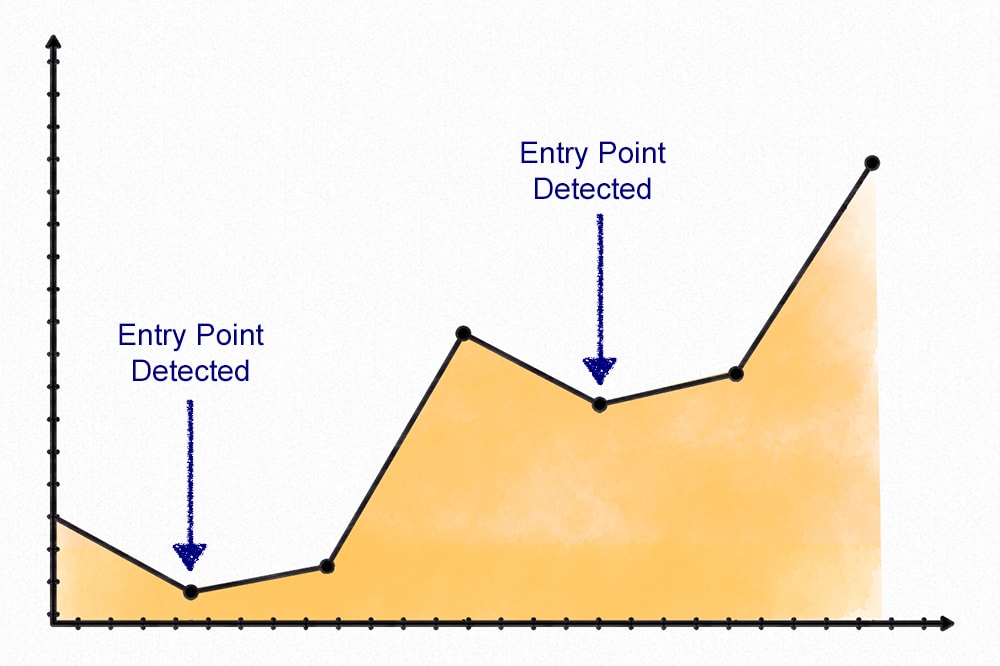

HIGHLY RELIABLE CHARTING PATTERNS

ETFs have highly reliable trading patterns from which a smart and savvy investor can identify precise entry points.The art is to buy ETFs at the right price & at the right time to maximize returns.

How do we do it?

1

We show you how the use of technical analysis charting patterns can help you identify high-probability winning trades.

2

We give you the knowhow to identify the precise entry points via these charting patterns.

3

We notify you to join us for "LIVE" demonstrations and commentary when we put Step 2 into practice.

The smart way of investing

THRIVING IN A "BEAR" MARKET

When economy turns bearish & negative, stock prices fall sharply. Confidence will be low and rightly so. However, these conditions may also present great opportunities to those with the right knowhow to capitalize and prosper from it.

Imagine being able to build a safety net in a period of turbulence and job insecurity.

Strong financial education is critical. Discover 2 ways a smart and savvy investor thrives in an economic downturn.

SHORT SELL STOCKS

This is a technique whereby an investor sells his stocks first at a higher price and then buys it back at a lower price. This allows the investor to profit from a price drop of the stock.

BUY INVERSE ETFs

Inverse ETFs are the anti-thesis of normal ETFs. The prices of inverse ETFs rises when the market drops. This allows the investor to profit from market crashes.

Loading...

Loading...